Unleashing Revenue Intelligence: Centralizing Conversational Data, Pipeline Health, and Forecasting

Revenue intelligence platforms like Gong, Clari, and People.ai unite formerly fragmented data (CRM records, call and email transcripts, calendars, and even marketing tools.) into a single source of truth. By automatically logging conversations and customer interactions, these tools surface actionable insights across the deal funnel. Sales leaders gain real-time pipeline visibility, more accurate forecasts, and unified alignment across Sales, Marketing, and Revenue Operations. In practice, modern teams no longer rely on memory or gut feeling; instead, they can now accurately see what happens in each deal and confidently predict outcomes.

Revenue intelligence delivers key benefits:

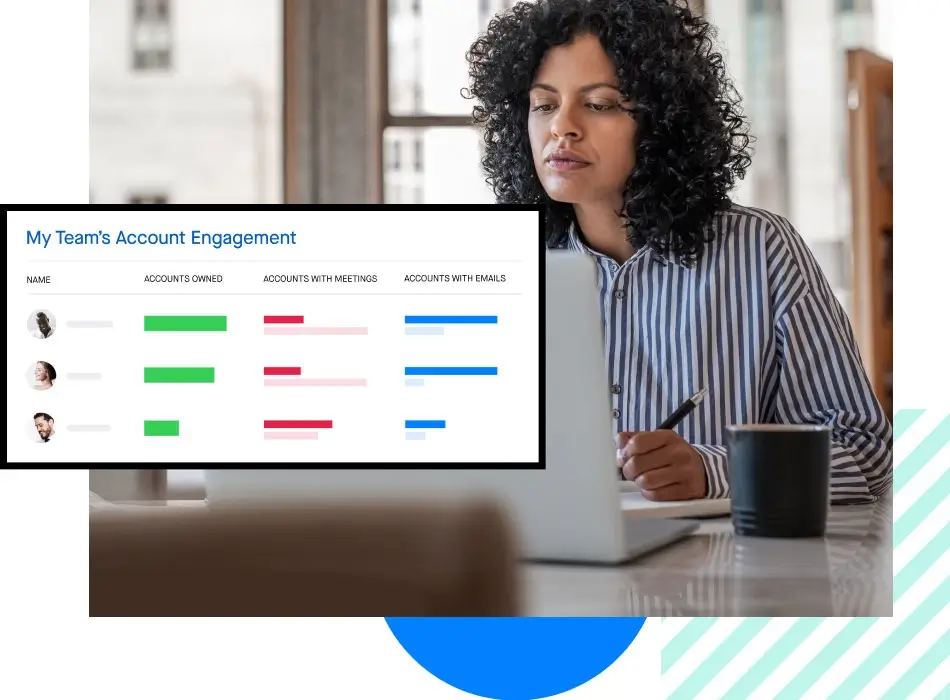

- Pipeline Visibility: Track every deal stage and quickly surface at-risk accounts. Managers get dashboards showing which accounts have recent meetings or are going cold.

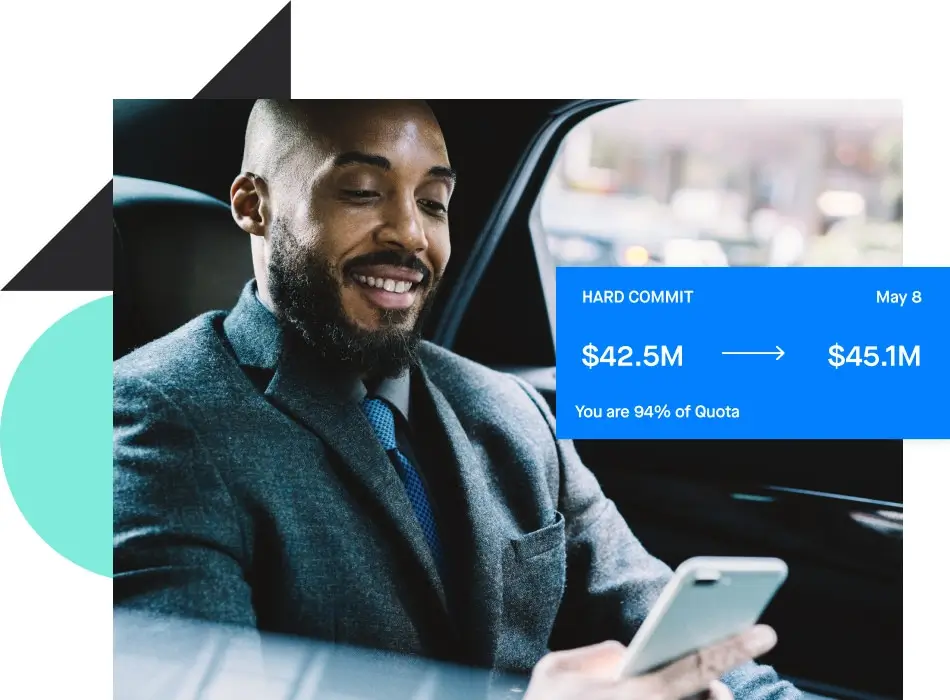

- Forecast Accuracy: AI models ingest 100% of sales signals (emails, calls, CRM updates) to “predict deal outcomes with ~20% more precision” than CRM-only forecasts.

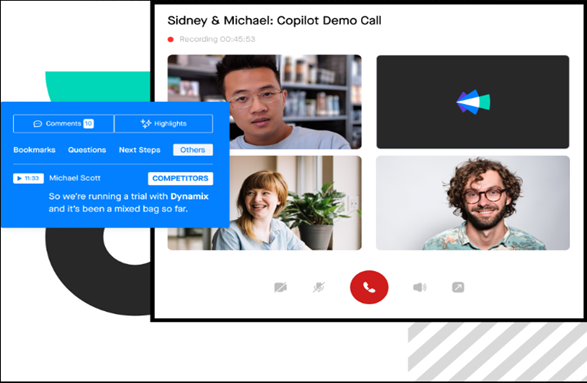

- Conversation Insights: Every call and email is captured and analyzed. Teams can automatically flag buyer sentiments or competitor mentions, uncovering hidden risks and opportunities.

- Rep Productivity: Automated activity capture frees reps from manual data entry, letting them spend more time selling.

- Cross-Team Alignment: Unified data bridges silos – Sales, Marketing, Customer Success, and Finance work from the same account insights, enabling coordinated strategies.

Clari’s Copilot conversation-intelligence interface (above) automatically transcribes calls and highlights deal signals. Without manual notes, it can flag red-flag topics like competitors mention or stalled next steps.

Clari’s pipeline dashboard (above) visualizes account engagement, e.g., green bars for meetings and red bars for stalled deals. Integrating these views with call analytics means managers can see which deals are healthy or at risk.

Evaluating Platforms: Gong vs. Clari vs. People.ai

When choosing a revenue intelligence platform, match the tool to your primary needs:

- Gong (Conversation Intelligence): Gong’s strength is capturing and analyzing conversations. It “analyzes customer interactions across calls, emails, and meetings,” using AI to coach reps and improve deals. Gong also offers pipeline features – its AI “automatically flags at-risk deals” by combining conversation signals and CRM data. Teams prioritizing in-call coaching, win-rate analysis, and real-time deal alerts will prefer Gong.

- Clari (Forecasting & Pipeline Health): Clari was designed specifically for forecasting and pipeline governance. Large sales organizations widely adopt it. (1,500+ customers covering $4T+ in revenue) to improve forecast accuracy. Key capabilities include AI-driven forecasts, real-time deal health scores, and collaboration tools like shared dashboards and “copilot” meeting summaries. Clari excels when precise forecasting and visibility for every deal are critical.

- People.ai (Data Capture & Analytics): People.ai automatically logs sales activities and surfaces engagement analytics. It “automates data capture and integrates insights across the organization,” eliminating manual CRM updates. The platform then provides a “revenue insights dashboard” so leaders can see contact roles, engagement levels, and buyer personas in one place. People.ai is a fit for teams needing to eliminate data silos and ensure all rep activities (emails, calls, meetings) fuel the CRM.

Key selection factors include integration ease and user adoption. All three platforms offer rich integrations (Salesforce, HubSpot, Slack, Zoom, and others) to connect your tech stack (hubifi.com people.ai). For example, People.ai’s Salesforce integration “automatically captures and populates activities” into accounts without requiring reps to change workflow. Clari similarly “seamlessly integrates with the tools you rely on, from CRM to messaging and video conferencing.” When evaluating, consider data connectors, UI simplicity, and the specific KPIs (forecast accuracy, deal cycle, win rate) that matter most to your business.

Integration Challenges and Solutions

Implementing a revenue intelligence platform may require tackling data and change management issues. Common hurdles include:

- Data Quality & Integration: Revenue intelligence only works if input data is complete and clean (meetrecord.com). Without duplication or errors, you’ll need to pull information from multiple systems (CRM, calendars, email servers, even marketing tools).

- Solution: Use the platform’s pre-built integrations and ETL tools. For example, People.ai can ingest 1.8M sales activities per hour, and Clari automatically synchronizes Salesforce data. Invest in data cleaning and validation routines upfront.

- User Adoption: A shiny tool fails if reps and managers don’t use it. Change resistance is real.

- Solution: Drive adoption with ease of use and training. People.ai highlights its “no change management” approach – it “works with your existing interfaces, sales methodology, and workflow.” Emphasize early wins (e.g., time saved, better deal visibility) and involve frontline reps in the roll-out.

- Workflow Alignment: Bringing conversational data into forecasts may require process changes. Define how insights get acted on (e.g., sales meetings incorporate intelligence reports). Clari’s guidance is to align all revenue functions with the new data flow – “marketing and customer success… on the same page” via shared dashboards.

- Scalability & Security: Plan for growth and compliance. Modern platforms are cloud-native and scalable but ensure robust security (encryption, access controls) for sensitive customer data. Vendors like Clari and Gong build enterprise-grade security into their tools.

By anticipating these challenges, RevOps can implement revenue intelligence smoothly. For instance, define the integration architecture upfront (CRM APIs, data lake connections) and designate data stewards to monitor quality continuously.

Measuring ROI: KPIs and Payback

When budgeting for a revenue intelligence investment, track quantitative gains. Key metrics include:

- Forecast Accuracy: Improved forecasting is a hallmark benefit. AI models tend to yield significantly tighter forecasts – Gong reports its AI can predict deals with roughly 20% more precision than CRM data alone (io). In practice, one customer (SpotOn) saw forecast accuracy jump to 95% within months of using Gong (gong.io) (versus much lower baselines). People.ai cites customers achieving ~92% forecast accuracy after centralizing activity data (people.ai).

- Win Rate: Closer alignment and coaching often boost win rates. For example, SpotOn’s win rate climbed 16% after adopting Gong (io). A Forrester study of Clari clients found an average 10% increase in win rate after full deployment (clari.com).

- Deal Velocity and Size: With actionable insights, reps close deals faster and larger. One case study notes that Gong users increased revenue per rep by 30%. Clari’s research also showed that customers had recovered an extra 6% of revenue previously “leaking” from their pipeline.

- Productivity: Automating data entry and alerts saves hours. Gong’s Forrester TEI study found that reps spent much less time on admin tasks (shaving weeks off onboarding new reps). The time saved can be quantified in seller salary hours or redeployed into selling.

Overall ROI: These improvements add up. Forrester calculated that Gong delivers roughly a 481% three-year ROI (net $10M NPV on $2M spent) (gong.io), while Clari’s platform yielded a 448% ROI in another study (clari.com). In other words, every dollar invested in revenue intelligence can return several dollars in captured or accelerated revenue.

Tracking these KPIs in your organization will illustrate value. For example, RevOps teams often measure forecast error (variance to actuals), pipeline coverage ratios, and quota attainment before and after roll-out. These should improve measurably.

Maturity Model: From Gut to AI-Driven Forecasting

Adopting revenue intelligence is a journey. A simple maturity model can guide staged implementation:

Stage 1 – Manual Forecasting: Sales rely on spreadsheets, verbal reports, and gut feel. Data lives in reps’ heads and email inboxes, making forecasts slow and error-prone.

Stage 2 – CRM-Driven: Teams adopt a CRM for pipeline tracking. Forecasts are based on rep-entered data, which gives a shared database but requires manual updates. Data gaps and siloed inputs remain.

Stage 3 – Automated Data Capture: Tools like Gong, Clari, or People.ai auto-harvest activity data from CRM, calendars, emails, and other systems. Opportunities are continuously updated with meeting outcomes and engagement metrics. This “inspection transparency” frees reps from logging every call and removes blind spots – managers can drill into any deal’s activity with one click.

Stage 4 – Predictive Analytics: AI can drive forecasting once data is consolidated. The platform generates ongoing predictive forecasts (no more static inputs) and surfaces patterns correlating with wins. At this stage, companies see significant improvements in forecast precision and can even prescribe the next-best actions for reps.

Stage 5 – Prescriptive & Collaborative: Revenue intelligence is fully embedded. All revenue-critical teams (sales, marketing, CS, finance) share a “single source of truth” for the pipeline. Insights are used to orchestrate coordinated plays (e.g., marketing actions for key accounts and CS alerts on renewal risks). Continuous feedback loops optimize processes over time.

For example, Clari’s thought leadership describes this progression from spreadsheets to “automated harvesting of activity data” to achieve transparency. As your company moves up these stages, you should plan around the expanded capabilities and change management at each level.

Forecasting Showdown: Manual vs AI-Driven

Consider a typical forecasting scenario:

- Manual Forecasting: Reps rely on memory and manual CRM updates. Managers run weekly forecast calls, asking reps to recount deal status or rummage through emails. Decisions are often based on anecdotes (“I think it’s closing”) rather than data. Gong’s Forrester study noted that before AI, teams “relied on their email inbox and memory” to discuss the pipeline. Accuracy is usually low – one Clari survey found that 93% of organizations couldn’t forecast within 5% of actuals using traditional methods.

- AI-Driven Forecasting: With a revenue intelligence tool, forecasting becomes data-driven. The platform automatically pulls in every relevant signal. For instance, Gong’s AI uses over 300 data signals to adjust real-time forecasts (20% more precisely than CRM-only models). Leaders see dashboards that update as soon as a call is logged or an email is sent. In practice, this produces dramatically better results: one company reported going from poor to 95% forecast accuracy within months of deploying Gong and a 16% lift in win rate.

In short, manual processes give way to “forecasts based on facts, not opinions.” The AI-driven approach proactively highlights deal risks and growth opportunities, whereas the manual approach can easily overlook them.

AI-powered platforms (e.g., Gong’s forecast interface, above) continuously update projections. In one case, leveraging Gong’s revenue intelligence transformed forecasting – within three months, the team hit 95% accuracy and saw a 16% boost in win rates (compared to their prior, error-prone process).

Evaluate your AI choice in RevOps

Step 1: Evaluating the Right Platform

Here’s a framework to evaluate revenue intelligence solutions:

| Criteria | Questions to Ask |

| Use Case Fit | Does the tool align with your biggest GTM challenges—forecasting, coaching, or pipeline visibility? |

| CRM & Tech Integration | Can it integrate natively with Salesforce, Slack, Outreach, or your current tech stack? |

| AI & Automation Depth | Does it offer AI-driven forecasting or basic analytics? |

| User Experience | Is the platform intuitive for reps and managers? |

| Scalability | Can it grow with your team across geographies and business units? |

| Support & Enablement | Is there onboarding, training, and RevOps support included? |

🛠 Pro Tip: Run pilot programs with 1–2 teams to validate adoption before scaling organization-wide.

Step 2: Addressing Integration Challenges

Integrating revenue intelligence platforms comes with technical and operational hurdles:

- CRM hygiene issues (e.g., missing fields, outdated contacts) can hinder adoption.

- Data silos between marketing automation, support systems, and sales tools may limit insights.

- Change management is often overlooked. Reps may resist AI-driven visibility into calls or deal status.

Solutions:

- Invest in data enrichment and standardization before launch.

- Partner with RevOps to build automated workflows that push insights back into CRM.

- Establish change champions within each GTM team to drive adoption and feedback loops.

Step 3: Measuring ROI

A successful implementation should be tied to measurable outcomes. Here are common KPIs:

| ROI Metric | Target Impact |

| Forecast Accuracy | Improve by 15–30% through AI-powered predictions |

| Sales Productivity | Increase rep capacity by reducing manual note-taking |

| Deal Velocity | Accelerate sales cycles by identifying stalled deals |

| Win Rates | Boost by enabling better coaching through call insights |

| Pipeline Coverage | Increase early-stage visibility and reduce risk |

Use pre- and post-implementation benchmarks to build your business case.

Revenue Intelligence Maturity Model

Here’s a simplified maturity model to guide adoption:

| Stage | Characteristics | Next Steps |

| Manual | Excel-based forecasting, rep anecdotes guide forecasts | Audit CRM data, define pipeline stages |

| Basic | CRM forecasting with limited call insights | Introduce Gong/Clari/People.ai to 1 team |

| Integrated | AI-assisted forecasting, call coaching, deal scoring | Automate workflows, unify data sources |

| Strategic | Predictive insights, GTM alignment, RevOps ownership | Tie data to hiring, territory, and quota models |

Manual Forecasting vs. AI-Driven Models: A Real Example

Manual Forecasting Scenario:

A sales manager pulls data from Salesforce and asks reps to update close dates and confidence levels. A large deal is marked at 90%, but no recent activity is logged in the past 3 weeks.

AI Forecasting Scenario (Clari):

The same deal is flagged at 40% due to lack of recent communication and minimal engagement from key decision-makers. The platform recommends next steps and alerts leadership.

Outcome:

The AI-driven model identifies risk earlier, allowing the team to proactively reallocate resources or adjust forecasts rather than being surprised at the end of the quarter.

Final Thoughts

Implementing revenue intelligence platforms is no longer a “nice to have.” It’s becoming a GTM standard for organizations serious about scalability, predictability, and performance.

Success lies in choosing the right tool and building a cross-functional strategy around data quality, process alignment, and change management.

Leave a Reply