In part two of this post on how to create a Sales Compensation Plan, I will show you the steps you should follow to create and implement a sales compensation plan. In this post, I will focus on the “relative plan” discussed in Part 1:

The first thing to understand is that building, rolling out, and managing a fair compensation model, is a complex process and is data-driven. You need to gather historical data, market data, competitive data, and put this in a digestible format that you can use to develop your model. Below are steps to guide you through this process.

What is a planning team, who is on it?

Your sales team in all its forms is your primary driver of growth, as well as the guardians of your current revenue stream. Sales is a collaborative process. You need to include stakeholders for different parts of your company to support the design of the sales compensation plan.

Members of your team should include your CRO or VP of Sales, as well as a seasoned Sales Representative. Remember that your CRO helps set the company’s overall goals and understands the team’s performance capabilities. Your Sales Rep brings the day-to-day sales perspective including awareness of what it takes to prospect and close a deal. They will supply an understanding of what your plan can do to support the existing reps and the effect the plan can have on Sales Rep retention and recruitment.

- Finance: Your Finance team is responsible to help you design the plan modeling and will look at the plan to create accurate cost assessment and properly accrue for these expenses throughout the year. They also align this with projected results and corporate goals. They can review the setup and maintenance of any proposed plan.

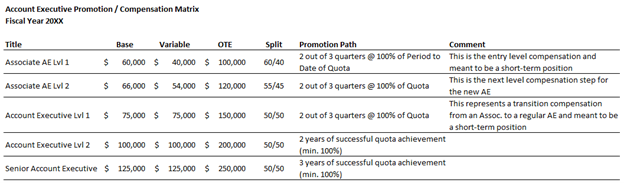

- Human Resources: With many companies, your HR departments may often be responsible for a Company’s overall compensation strategy and understand the current state of the market with bench-marking and market compensation They handle not only this but bring expertise in regulatory compliance, employment law. They look at the roles and how to support a career path for Sales. Below is an example career path:

- Marketing (Both Direct Marketing and Product Marketing): For any team to sell, they need leads and prospects, so it is vital to gain input from your Products and Marketing teams. They provide you information on current GTM strategies and upcoming product releases or announcements that may affect your sales funnel.

- Legal: Remember that the sales compensation plan is a legal document and therefore it should always be reviewed by your legal team before you share your plans with your Sales team(s).

Review your current plan.

The first step is a look at how your current plan has worked. You should gather feedback:

- Sales will supply insight on the prior plan, how did your rep(s) perceive the plan.

- HR look at what the market is paying and what your competitors are doing.

- Finance looks at the CAC and if the plan is driving the financial behavior that leads to revenue and profitability for your company.

- Revenue Operations looks at how the plan is performing for your reps, are you rewarding your top reps, and not rewarding your under-performing reps. Remember, a good plan will be designed to reward your top performers.

After this analysis and review – do you need to change the Sales plan?

- Has the market changed?

- Do you need to hire?

- Is the retention of Sales talent an issue?

- Will your product have a new release?

- What is your competition doing?

- Are their pending political or shifts in buying behavior to consider?

- Do you have new goals?

- Will quotas need to be adjusted?

Understanding and incorporating your company’s business goals is paramount, your plan is designed to drive specific behaviors. Your plan needs to be focused on measuring and incentivizing your rep’s performance that will support your company’s goals. Here are examples of business goals you may need the plan to address:

- What is your company’s annual sales goal for the planning period?

- What is the overall budget?

- How many reps do I have?

- What types of compensation plans do my competition use?

- What will my salespeople expect out of the plan implemented?

- What are the company and the team’s business goals?

- Grow revenue by X%

- Increase the average contract length

- Increase the average deal size

- Increase retention rate

- Increase upsell or cross-sell rate

- Drive sales for the specific product

- Revenue from new business vs. revenue from existing customers.

- Market penetration

As said above it is important that your sales goals should be closely aligned with your business goals. By strategically aligning your business and sales goals, you can ensure your sales force is driving success at the organizational level.

Align plan with Sales roles:

With your business strategy in place, you can now focus the plan on your sales team(s). Fully identify all the sales roles within the organization that you will include in the commission plans.

Below are examples of common roles:

- Business development representative (BDR): Concentration on lead prospecting. (aka SDR Sales development rep, LGR, Lead generation Rep…)

- Account executive (AE): Concentration on getting net new customers.

- Solutions Consulting (SC): Works with the AEs and AMs to supply technical support during the sales process (demos, trials…)

- Customer success manager (CSM): Concentration on on-boarding and training the customer to get the most value out of the product/service.

- Account manager (AM): Concentration on renewal, upsell, and cross-sell from existing customers.

- Channel Manager (CM): Concentration on new and/or added revenue from Partners/Resellers/VAR’s.

Each of these roles should be bifurcated into entry-level, mid-level, and senior-level positions that can have varying pay structures. You will need to decide target pay, pay mix, and upside potential for each sales role. Each sales role will need a specific compensation plan.

What are the On-Target Earnings?

Using the Relative commission plan, review and analyze, what the market is paying, by Industry, by Geography, Skillset? The OTE should have two elements, base pay, and incentive pay. Look at the Salary survey from your planning session to decide your team(s) OTE. Once you have determined the OTE, this will give you the base of your compensation plan.

What should the compensation plan provide?

Keep it simple! Your plan should be one or two pages for your Sales Reps. Do not use the plan to address every detail, these details should be incorporated into a compensation T&C’s document that is referenced in the actual plan you present to the Sales team. Only have the plan show the actual metrics you track, (# of new leads created, number of meetings set, net new revenue generated…) Do not add conditions that are difficult or even impossible to track, (how would you like to be paid on a pipeline that can be subject to change daily/weekly or monthly?)

- Align your performance measures to the company’s goals. An effective plan will incentivize and drive the behaviors that will further your company’s goals, an example; decrease churn, or close multi-year contracts.

- Provide Real-Time Visibility. Make certain that the Rep’s can easily calculate how much incentive they can earn, whether this is a commission calculator or a dashboard in your CRM, they need a way to calculate how much money they can make and where they are on a YTD progression related to quota achievement.

- Be prepared for staff churn as well. Turnover in sales can be high. Be ready to add this to your planning, as you will need to account for ramp-up time for any new hires and other challenges that can happen. Always leave room to adjust as needed.

- Budget for SPIF’s and bonuses. Make sure you can provide spot bonuses or other sales incentives as needed.

- Make it fair for everyone. Your plan should be designed for everyone and treat everyone equitably.

- Payout formula. This is the primary component of the plan, it lets the Sales Rep know how they are paid and what are the potential earnings on target, and the upside if they exceed targets.

- Plan Governance. This detail how you will resolve conflicts or questions over sales compensation that are not covered in the plan and may arise, in some states you may need to have a fair compensation board. Make sure you follow the philosophy of Fair Compensation to be equal, regardless of gender, age, race, etc.

Set Quotas and Expectations

How you set targets depends on your specific business model. You need to consider a wide range of factors, including, your financials, whether you receive recurring revenue, do you charge for services (what is revenue to services split). Keep in mind that you can never have the perfect plan. Your plan will be constantly shifting – changes in the market, buyer behavior changes, new competition, exploited loopholes in your current plan…

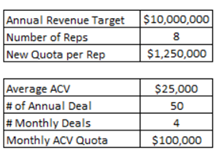

Let us dive into examples of quota setting for your individual reps and/ or your team. You want to document the expectations for compensation with your reps, so everyone is aware of what is expected of them and how they can make money. So, question one is how do you decide what a fair and achievable quota should be quota should be?

There are two main approaches to setting quotas.

Bottom-Up

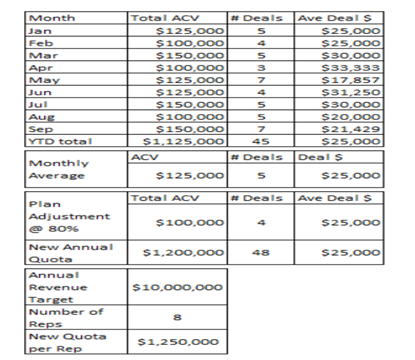

Review your team’s past performance and average the performance in the last closed months, most sales experts then use 80% of that average as the base. As an example, look at the last 9 months of your top rep and you can begin to calculate the new quota.

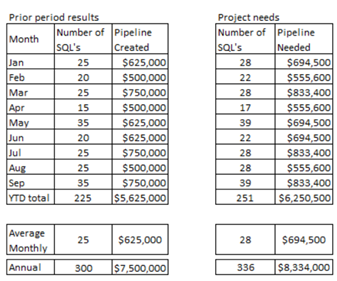

With this approach consider the dependencies. To make sure your plan is fair; you also need to look at the pipeline creation for your rep(s). Below is a review of the number of SQL’s (pipeline) that would be needed to meet this new goal. With this review, we assume a 5 to 1 conversion rate from SQL to a closed deal.

Consider the reps and team’s capabilities, as well as the perceived market opportunity you found in your TAM analysis to determine what each territory’s and/ or salesperson’s quota should be. The more data you have here, the simpler this will be. When building these quotas consider the factors below as a minimum.

- Average contract value (ACV) or average deal size.

- The average revenue per salesperson

- Number of salespeople

- Number of qualified leads (per month or quarter)

- Percentage of qualified leads that close

Top-Down

With a top-down approach, you combine your TAM data with your annual revenue targets to determine the amount per rep you need to bring in. Divide your annual ACV by the number of reps, multiply this by your average ACV and you can determine the annual and monthly quota you would need from each rep.

The biggest challenge here is this does not account for changes in territories or regions, as an example, a mature territory has a lot of market potential, whereas another may be newer and not have the right mix of prospects for your products, but each rep’s territory has the same goal.

Presenting Your Sales Plan

Presenting the plan is vital and needs to be part of your compensation planning. How many times have you heard “My quota goes up and my territory shrinks”? Presenting a new plan to reps can be met with a challenge from sales teams and management and often create questions such as:

- The plan is not achievable, how can I meet these goals?

- The ability to exceed quota is throttled

- Wary of what “management thinks are good for the company”

- Poor communication or often lack of understanding of how the plan can maximize their earning potential.

You need to provide the reps with data in a simple and transparent way to show the rep the path to success. This should focus on the differences between the new and old plans, showing the reps how to meet and exceed targets. Make sure you provide this to each rep and ask if the plan provides:

- Clear sales objectives?

- How does the plan work?

- Is it easy for the reps to understand the relationship between pay and performance?

- Will the incentives encourage the behaviors we need to meet your goals?

Here is a link to an example of a presentation you can use to present your plan to your rep(s). I also provide a link to a sample file where you can make changes to the assumptions. TAM & Pipeline SAMPLE

Also provided are samples of the plan documents that you can review as templates for your use. If you use these templates, it is highly recommended your HR and Legal teams review for content and clarity for your business.

FYXX Sales Compensation Terms and Conditions SAMPLE ONLY

NOTE: In no way am I responsible for your use of these documents, as they are illustrative only for this blog.

Maintain the Plan

Now you have completed the plan preparation and are ready to present these to the individual reps you need to have a process to review your plan for results. In business, today things evolve quickly, and you need to be able to react immediately to these changes.

- Did your business goal change?

- Did your team grow, and new territories were created?

- Was there an evolution in the market, a new product line introduced, a new competitor in the market?

Remember this plan is not written in stone and you should be able to adjust quickly. What you thought worked today, may not be relevant tomorrow. Have a process to review and update the plan to focus your reps on the right behavior that positively affect your business’s bottom line.

Final things to consider

How is compensation paid?

- Upon contract signature.

- When the first payment is received.

- 50% on the signature, 50% on payment in full

These payment methodologies have both positives and negatives. If you pay on signature then the reps see immediate results from their efforts, but this can lead to cash flow issues for the Company if there is a delay in receiving payment from the customer.

The most common method is “upon payment”, but this can delay payment to the rep due to customer late payment, that is some cases never happens. This can lead to disgruntled and under-motivated reps.

The other method of 50% on signature and 50% on payment is also popular but can be a tracking nightmare for both the company and the rep.

No matter what method you choose, make sure to communicate this clearly to the rep(s) to eliminate potential future issues on compensation. My rule of thumb is “a paid rep is a happy rep”, and “Do not mess with their wallet”.

Monthly or Quarterly Payouts?

The recommendation is to pay monthly, this has two effects, it provides immediate rewards to the rep, and eliminates the bigger outflow of cash, and will lower the hockey-stick curve (most contracts come at the end of a quarter). Also, it is important to work with Finance and HR on payment timing. It is normal to pay compensation on the 2nd payroll after the end of a booking period (this is normally 30 days after the contract close date).

Caps on Compensation

Do you cap the maximum incentive for your sales teams? This should be used sparingly, as caps can be seen as a de-motivator, especially for those reps that are able to exceed your target, as noted above, in maintaining your compensation plan, you should evaluate the plan components and adjust this as needed. If you do have a cap in place make sure you document this and add to the compensation terms, as well as have them read and accept this in your plan.

Leave a Reply